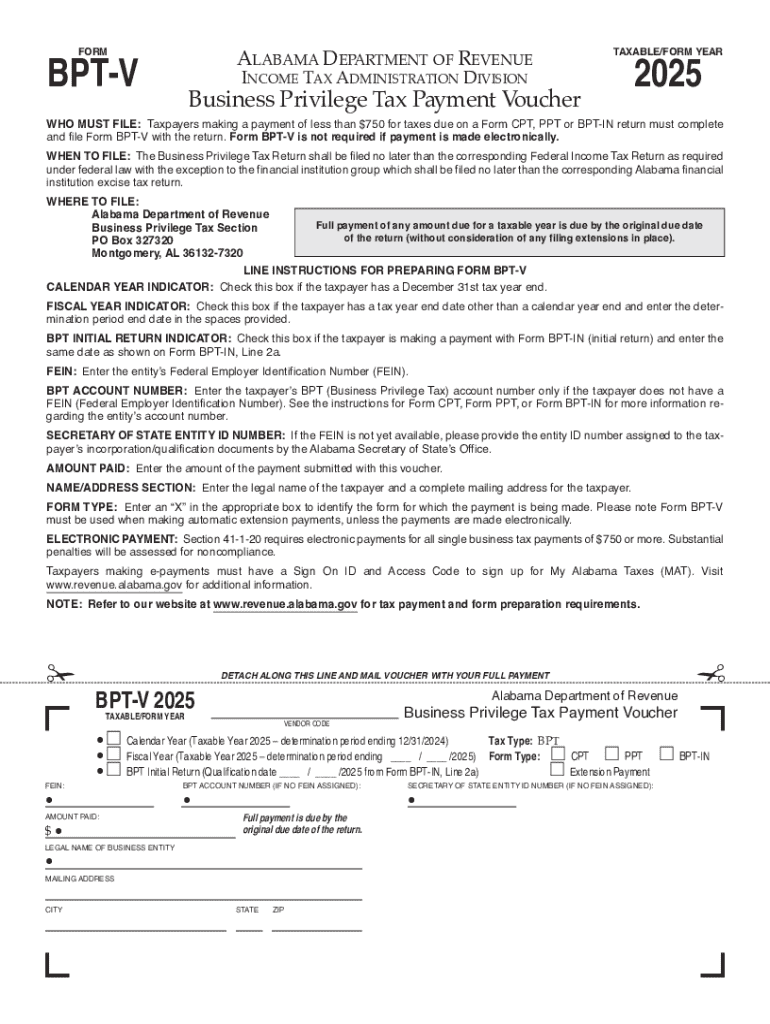

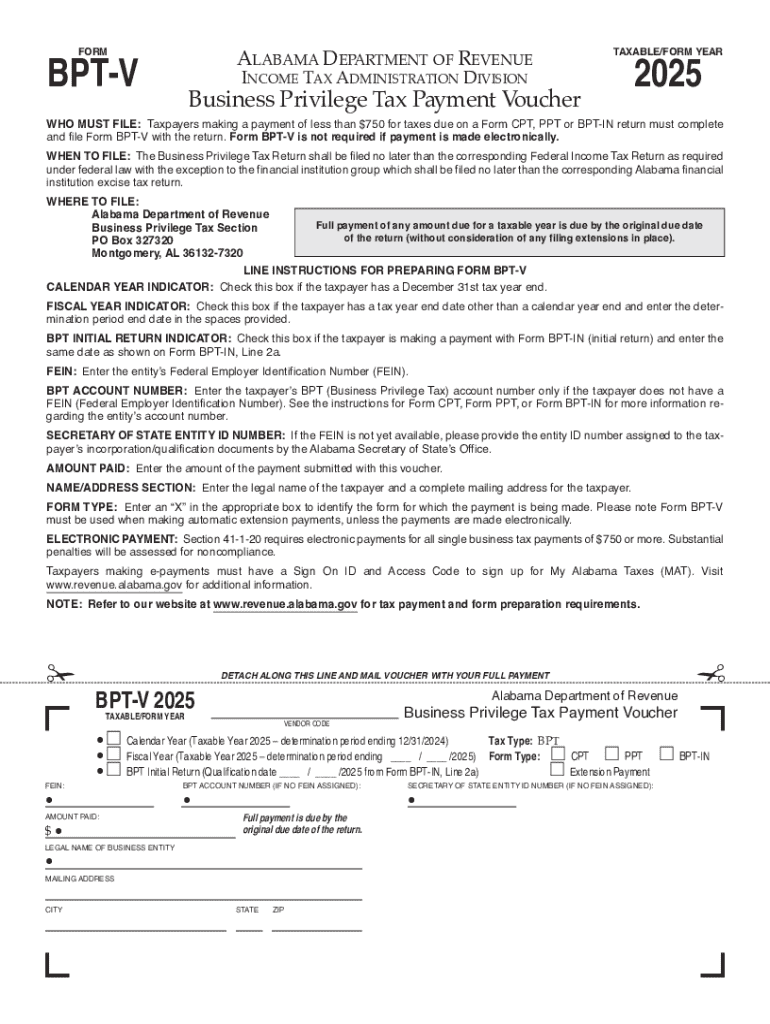

AL ADoR BPT-V 2025 free printable template

Get, Create, Make and Sign alabama business privilege tax form

Editing alabama bpt v online

Uncompromising security for your PDF editing and eSignature needs

AL ADoR BPT-V Form Versions

How to fill out alabama business form

How to fill out AL ADoR BPT-V

Who needs AL ADoR BPT-V?

Video instructions and help with filling out and completing alabama voucher

Instructions and Help about bpt

What little Oh who could be knocking at this our brother what brings you here mom's dead how I forget, but I need a place to stay well I'm going to stop you right there brother I have an idea you can live with me hey that sounds like a great idea no shit come on I'll show you around or Kurt where are you going I'm headed to work you want to tag along sure where do you work I work at a TV station, but I'm running late boy let me just pop on my shoes so what station you work at BP TV never heard of if it's on channel 831 moms didn't have satellite well here we are whoaed it looks nothing like a TV hey mister boss pepper oh thank gosh you're here we're running late who's this is my little brother I'll call you salt I don't like that Barry it is Mr. boss likes didn't mean people after food hey toots II get in here yes boss Joe Barry and pepper around the office will you right this way boys uh you do know I work here right here we have the boss's office I should really get to my office here's the news area yes we do use on our channel I really need to go to my office MMM this is the main room where all the behind-the-scenes action takes place you know what I mean come on I need to get to my office oh I'm so sorry honey go ahead thank you and uh here we have the food table whoa excuse me miss TV you might want to turn around for this hey man you should try some of this food it's got a kick not now I'm in the middle of figuring out next week's schedule ever I need you on the set now coming Mr. boss what about me just staying here for a little I'll be right back right Oh okay pepper I need you to operate the lights, but I've never operated the lights before we're on in five four whoa o3o mister bye — boom Mr. Bozo oh well that was a close one hey guys I feel more food oh no Mr. boss is he okay asses to assess but stupids Frederick fine doom was a fine man this really sucks I've known that man almost my entire life what do you think is going to happen to the TV stations who know somebody's probably going to buy it now that he's gone and now the reading of the will to my dearest friend based acquaintance love it papers oh I leave you yes my entire life's work which is my legacy my pasture the anxiety my years collection of thimbles that resemble presidents hates well alright that's not so bad and the TV station me my buddy took her out of town just putting in tactical look around going to make it we have to beat up four and a heap of time got nothing to lose got a place in mind got a beat.

People Also Ask about alabama form bpt v

What is Alabama tax form 40?

How often is Alabama business privilege tax due?

What is the business privilege tax in Alabama 2023?

How often do you pay business privilege tax in Alabama?

How do I file my business privilege tax return in Alabama?

How much is the al bpt tax?

What is Alabama BPT tax?

How is the Alabama business privilege tax calculated?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send bpt v for eSignature?

How do I complete bpt on an iOS device?

How do I complete bpt on an Android device?

What is AL ADoR BPT-V?

Who is required to file AL ADoR BPT-V?

How to fill out AL ADoR BPT-V?

What is the purpose of AL ADoR BPT-V?

What information must be reported on AL ADoR BPT-V?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.